聰明的錢都在放空

希臘、西班牙、葡萄牙、和日本

大家要小心了,

原本在天邊的烏雲

現在已經罩頂了。

敏感的人已經聞到了暴風雨的味道

路上也開始吹起了濕熱的風…

三年前(真快!)次級房貸危機

你有藉口說「來不及準備」

「根本搞不清楚就被金融海嘯打到」等。

這次又來了,

失業?關門倒閉?經濟蕭條?

反正光是從金額來看,

會比2007~2008的金融海嘯

大兩倍以上。

大家趕緊加速打造自己的財務方舟,

真的迫在眉睫了。

先從退出股市、基金、與投資性的房市;

有在開公司的,能先進貨囤貨趕快做;

聽得懂,也懂其中道理的人,更進一步就是

手上千萬不要持有「定存」以及「每月還本」的保險;

雖然要買黃金和白銀以備不時之需,

但是千萬別去銀樓亂買一通。

但是這次國家違約倒帳風波

和2007次級房貸不同—

規模與影響範圍大太多了

StreetTalk With Bob Lenzner

Smart Money Is Short Debt Of Greece, Spain, Portugal And Japan

Robert Lenzner, 04.30.10, 05:00 PM EDT

But the sovereign debt crisis won't be another subprime meltdown.

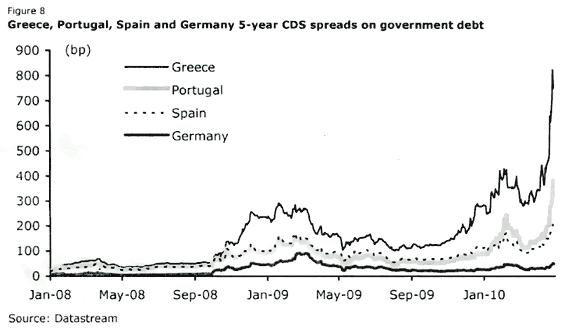

Smart money went short the bonds of Greece, Portugal, Spain and Ireland when the price of buying protection against default was cheap, some weeks ago. The price of buying insurance against default has spiked now that the crisis is full blown and a $100 billion bailout of Greece is not a done deal.

The Smart Money, mostly hedge funds thinking ahead, were betting on the historic findings that over 800 years severe recessions are always followed by sovereign defaults. Smart Money had studied This Time is Different, a history of financial crises by Harvard professor Kenneth Rogoff and his co-author, Carmen Reinhart.

You want perspective on more than 2008-09, you have to read this book. One clear finding of Reinhart/ Rogoff is that sovereign debt default is in “a cyclical trough” based on a chart published by Hedgeye Risk Management this week. The percent of countries in default or restructuring is about the same as in 1930 as the depression took full force.

Smart Money is worried. It has seen the need for bailouts segue from a few billion dollars for a single hedge fund, LongTerm Capital in 1998, to trillions on behalf of banks, insurance companies and quasi-public institutions like Fannie Mae ( FNM - news - people ) to prevent an economic meltdown equal or worse than the 1930s. European Central Banks needed 27.5% of total European GDP to staunch the wounds, according to Jean-Claude Trichet, ECB chairman, at the Council on Foreign Relations this week. “The transmission of shocks were moving rapidly every half-day. There was no textbook to tell us what to do,” he said.

Nor was he forthcoming about the odds of a deal for Greece. At stake in the first instance are European bank loans to Greece ($190 billion), Portugal ($240 billion) and Spain ($840 billion). That's a nifty $1.2 trillion exposure to the economically vulnerable European nations. Faced by French banks like Societe Generale, German banks and British banks as well. A big problem, but not of the proportion of the subprime crisis, which morphed into prime mortgages, LBO loans, credit card and automobile debt--making Citigroup ( C - news - people ), Bank of America ( BAC - news - people ), Fannie Mae, Freddie Max, WAMU and others in effect insolvent. Still, a challenge to European bank balance sheets and further deterioration in European stock markets could be destabilizing.

原文(全)連結:

http://www.forbes.com/2010/04/30/sovereign-debt-subprime-smart-money-markets-greece-lenzner-streettalk.html

看更多...

留言列表

留言列表